On November 15th, the 22nd Guangzhou Auto Show officially opened. At this auto show, all its models were unveiled at the auto show, in which Deep Blue L07/S07 not only provided pure electric power and deep blue super extended range, but also equipped with Huawei Gankun intelligent driving system. The dark blue G318 is positioned as a new energy hard-core SUV, and the design style of cyber mecha makes it a brand-new category.

Deep Blue S05 is a brand-new model launched by Deep Blue Automobile in the compact SUV market. This car is the latest masterpiece of Deep Blue Automobile’s deep connection with young users in the new era, and it has a more eye-catching performance in scientific and technological interaction. The new car provides both pure electricity and extended range power at the same time, and the price range is 11.99-14.99 million yuan.

The new car adds flying elements on the basis of retaining the deep blue family style, especially the front shape is sharper and more dynamic. It is worth mentioning that the headlights also have HUAWEI XPIXEL technology blessing, equipped with 1.3 million pixel intelligent light and shadow headlights and 120-inch large projection frame, which not only has 6 kinds of lighting auxiliary functions, but also can project different light effects, which is very obvious for the improvement of interactive experience.

Although the positioning is more introductory, hidden door handles, borderless doors and 20-inch wheels are all equipped. In addition, there is a round light group at the left back door of the car body, which can display the power and charging status, and young people will definitely like it.

The interior is also the latest minimalist design of the deep blue family, which cancels the traditional instrument panel and replaces it with a 50-inch AR-HUD head-up display. The overall style is simpler and more capable. In terms of intelligent configuration, Deep Blue S05 is also equipped with an intelligent emotional interactive cockpit, which is equipped with a 15.4-inch 2.5K central control panel, a built-in 8155 chip and a DEEPAL OS 3.0 system, so you don’t have to worry about operating logic or fluency.

In addition, some models are also equipped with Deepal 4K intelligent pan-tilt camera, which supports social functions such as intelligent one-click capture, Vlog creative shooting, scheduled time-lapse photography, one-click editing and 180 panoramic fun shooting, which can further enhance the interactive experience.

Deep blue S05 positioning compact SUV, its length, width and height are 4620/1900/1600mm, and its wheelbase is 2880 mm. The front and rear rows can comfortably ride an adult male with a height of 1.9m at the same time, and the space is very practical. The central armrest box has a volume of 13L, the storage box on the first floor is divided into 3.5L, and the 9.5L space on the lower floor is used as an incubator. The outer wall adopts an integrated air conditioning duct structure, and the lowest refrigeration temperature can reach 5 C. Although it is not a refrigerator, it can also play the role of refrigeration and heat preservation.

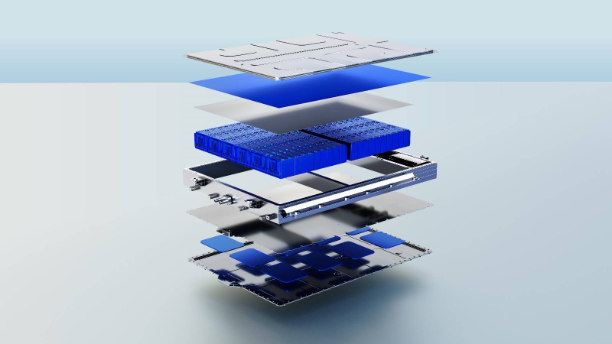

Deep blue S05 provides both extended range and pure electric power. The extended range version of the real shot is equipped with a 1.5L new blue whale hybrid special engine and a rear motor. In terms of cruising range, the pure electric cruising range is 200km(CLTC), and the comprehensive cruising range can reach 1234km(CLTC). The pure electric version of the pure electric version is equipped with a 175kW single motor and a battery pack with a battery capacity of 56.12kWh. The CLTC pure electric cruising range is 510km. At the same time, the new car also provides 3C fast charge, and the SOC30%~80% charging time is ≤15 minutes.

Deep Blue L07 is a brand-new medium-sized sedan owned by Deep Blue Automobile, which is equipped with Huawei Gankun Intelligent Driving System. In terms of power, both pure electricity and extended range are provided, and the price range of new cars is 151.9-173.9 thousand yuan.

Deep Blue SL03 is made for the young people who are passionate because of their love, focusing on the appearance of sports technology, and bringing "good-looking, easy to drive and smart" driving pleasure to young people who are willing to adopt early adopters and pursue individuality, while Deep Blue L07 is positioned as a "medium-sized car with scientific intelligence", focusing on intelligent technology, which is suitable for young families who pay attention to the quality of life, are good at pleasing themselves and pay attention to scientific intelligence at the same time. Therefore, as two completely independent models, the two cars will be sold at the same time, forming a deep blue double sedan product lineup to meet the needs of customers of various ages.

In terms of appearance, the overall design of Deep Blue L07 continues the family design of SL03 with dynamic science and technology. The front of the whole design runs horizontally, which increases the traction visual width, and has a considerable visual impact. With the lateral forward posture, it shows the dynamic posture of the car body. From the side of the car body, the shape is slender and dynamic, and the blackened door frame enhances the sense of movement on the side. In terms of body size, the length, width and height of the new car are 4875/1890/1480mm and the wheelbase is 2900mm respectively.

In terms of the rear end, the new car is still equipped with a penetrating taillight group with a length of 1.2m, which has a very high vehicle recognition with the illuminable LOGO. In addition, the new car is also equipped with an electric lifting tail, which can bring a windward force area of 0.256㎡ when it rises. In the speed-following induction mode, when the speed reaches 90km/h, the tail will automatically deploy. When the vehicle speed reaches 170km/h, it can provide 145N downforce for the whole vehicle, making the grip stronger and the driving more stable.

In terms of interior, the dark blue L07 also adopts a minimalist interior style, and the yacht-style embracing design and 64-color atmosphere lights create a good sense of luxury. Both the driver’s seat and the driver’s seat support zero gravity, and have the function of ventilation, heating and massage. In addition, Deep Blue L07 also provides intelligent fragrances with three themes, namely, deep sea voyage, boundless universe and sunset flight. The vehicle supports functions such as fragrance identification, fragrance selection, fragrance concentration adjustment, fragrance residual display, fragrance memory, and linkage with relaxation mode.

In terms of intelligent configuration, the center console is equipped with a 15.6-inch sunflower screen with high resolution of 2560*1440 and 2.5K. In terms of functions, the built-in Deepal OS system has the functions of voice interaction, APP download, online entertainment, online map, mobile phone interconnection, remote control and OTA upgrade, and supports intelligent recognition of 12 scene modes. Voice interaction can be seen. With the 8155 car gauge chip, it can bring a smooth and intelligent operation experience.

In terms of intelligent driving, Deep Blue L07 is equipped with Huawei Gankun intelligent driving ADS SE system, which provides intelligent driving functions such as NCA intelligent driving navigation assistance, urban cruise assistance and intelligent parking assistance. The system adopts a more comprehensive sensing strategy, which not only depends on the camera, but also integrates the data of various sensors such as radar and ultrasonic sensors, making the vehicle more humanized in decision-making and planning, and the driving trajectory closer to human driving habits, thus improving the traffic efficiency and driving comfort.

In terms of power, Deep Blue L07 offers two options: extended range version and pure electric version. Among them, the pure electric version is equipped with a 185kW motor, and the acceleration time of 0-100km/h is only 6.2s. In terms of battery life, it is equipped with a 56.12kWh battery pack with a cruising range of 530km.

The extended range version will be equipped with a 72kW 1.5L range extender, and the driving motor power will be 160kW. In terms of battery life, the new car offers two pure electric battery life versions, 230km and 300km. The comprehensive battery life is as high as 1400km, and the fuel consumption is as low as 3.94L/00km. At the same time, it comes standard with the first 3C overcharge at the same level, which can last for 100 kilometers after 10 minutes of charging.

Deep Blue S07 is positioned as a "new mainstream medium-sized SUV". It is also the first model of Deep Blue Automobile equipped with Huawei’s Gankun intelligent driving solution. The new car also provides both pure electricity and extended range power, and the price covers 149,900 ~ 212,900 yuan.

In terms of appearance, the size, length, width and height of the new car are 4750x1930x1625mm, which is visually wide and looks more dynamic. The wheelbase of 2900mm on the length of 4750mm is very prominent. Moreover, the use of hidden door handles, frameless doors, etc., while optimizing aerodynamics, the drag coefficient is only 0.258, which improves the cruising range and NVH.

In addition, the new car is also equipped with intelligent interactive lights, which can customize the interactive lighting effect editing function and realize projection interaction, and can realize the effects of pedestrian comity, driving state reminder, special scene animation, etc. Users can customize the lighting language and enhance personalization and playability.

In the interior, yacht-style embracing design and 64-color ambience lights are used to create a good sense of luxury. The seat is designed with fluid gradual perforation and forest veins ripple, which is full of natural atmosphere as well as scientific sense. Moreover, the front driver and passenger seats all support zero gravity and have the function of ventilation, heating and massage. The whole car is equipped with 14 high-quality speakers and external amplifiers, which can realize various audio-visual modes such as concert hall and cinema mode. There is also a 1.9-screen panoramic canopy with electric sunshade.

In terms of intelligence, 15.6-inch 2.5K ultra-high definition sunflower screen, 12.3-inch screen with ceiling, 55-inch AR-HUD, main driver’s headrest sound, 50W wireless fast charging and complete configuration. Assisted driving is equipped with Huawei Gankun intelligent driving solution, which supports high-speed navigation assistance and intelligent parking assistance.

In terms of power, the Force is used for super extended range, and all rear wheels are driven. The maximum power of the system is 190kW, the extended range version accelerates for 7.6 seconds, and the fuel consumption per 100 kilometers is 4.9L under CLTC standard. The pure electric version accelerates by 7.5 seconds. Using the golden bell jar battery 2.0, with pulse heating technology, you can quickly activate the battery in the cold weather in winter, so that you can use the car in winter without worry. The extended-range version has a pure battery life of 215km/285km, with a comprehensive cruising range of up to 1,200 km. It is equipped with 3C fast charging, and 30%~80% of it takes less than 15 minutes to charge.

Deep blue G318 is a special sequence of deep blue brand, and its model positioning is light off-road SUV. However, it still has two deep blue brand labels: youth and technology. And around the four revolutions of new modeling, new energy consumption, new space and new comfort, the "four major pain points" of traditional hardliners are solved. In terms of selling price, the price range of new cars is 175,900-318,000 yuan.

In terms of appearance, the overall design of the new car is tough, with straight lines and rounded rectangles to create a retro hard-core flavor popular this year, and the overall outline is very powerful. The style of the front face is very strong. Cybermetal’s grille-free visor +C-shaped headlight group creates a unique avant-garde feeling for new energy vehicles. In addition, the fender under the protruding bumper is in a grille shape, which also adds more wildness and mech to the whole front.

The design of the hidden door handle on the side of the car body is conducive to reducing the wind resistance. The cutting surface formed by the waist line and the roof line brings a strong sense of strength, and the front and rear raised wheel eyebrows highlight the tough style. In terms of body size, the length, width and height of the new car are 5010/1985/1960 mm (including spare tire and spotlights), the wheelbase is 2880mm, the approach angle/departure angle is 27/31, the longitudinal passing angle is 27.3, and it also has a ground clearance as high as 240mm, and the drag coefficient is 0.35Cd.

The new car also provides luggage racks, headlights, electric pedals, backpacks, spare tires and other original expansion parts. It is worth mentioning that the dark blue G318 four-wheel drive model has towing qualification, and the maximum towing quality can reach 1600kg.

In the rear part, the trunk door adopts the side-opening structure common in off-road vehicles, and the strong black bumper at the bottom is very recognizable. The taillights echo the headlights and also adopt the C-shaped shape.

The interior modeling continues the hard-core design style of the whole vehicle. In order to highlight the positioning of its hard-core SUV, handle elements are also designed in many places in the car, but the center console takes an exquisite route, where square outline lines are used in a large area, but the lines are softer and the new energy atmosphere is more sufficient, but many physical buttons are also retained in the car. In addition, the new car also has a 12.3-inch full LCD instrument panel and a 14.6-inch central control panel.

In the power part, Deep Blue G318 is equipped with extended-range power system, in which the maximum power of single motor version is 110 kW; Front and rear dual-motor four-wheel drive version, in which the maximum power of the front motor is 131kW, the maximum power of the rear motor is 185kW, the total power of the system reaches 316kW, the 0-100km/ acceleration time is 6.3s, and the maximum external discharge output power is 6kW.

In the chassis part, the new car has a double wishbone+multi-link independent suspension, a central stepless differential lock and a magnetic mechanical differential lock. In addition, the magic carpet +CDC+ suspension is also standard. At the same time, the new car integrates 16 driving modes, including 5 daily modes, 5 terrain modes (wading mode, snow mode, rugged mode, mud mode and sand mode) and 3 special scenes (in-situ U-turn, steep slope descent and off-road crawling). With three energy management modes.