By the second decade of the 21st century, what would have been regarded as an unprofessional profession has gained more and more recognition, such as e-sportsman, net writer, video blogger or network anchor.

Ten years ago, when these employees returned to their hometown, they might all be classified as "computer sellers." But now, no one in my hometown has a smart phone, and everyone can be an audience of games, online texts, videos and live broadcasts with 4G&5G&Wi-Fi coverage.

It is not spring to stand out from the crowd, but it is spring to be colorful. If you take a look at the major video websites, most of the popular domestic animations and many domestic TV dramas are adapted from the classic web IP, whether it’s Douluo Mainland, which is coming to an end, or Fighting through the Sky, which was very popular last year, or Full-time Masters before that, etc.

In the network text, video content, games, and the surrounding industrial chain, the network text is always upstream. If there is no online text, then the annual drama nirvana in fire, Joy of Life and The Beginning will not exist, and even the original novel of the TV series Big Rivers with a strong sense of the times is also an online novel.

In other words, the content will be rich and colorful when the IP is circulated.

In 2002, qidian was born, and then a lot of news about the myth that online writers made money appeared. When many writers worked hard for several years to write a novel and publish a paper book, the final royalty income was only tens of thousands of yuan, a number of online writers were able to earn seven or eight figures.

It is true that the "28 Law" and even the "19 Law" are distributed in most industries. For example, many young people who are inexperienced have dreams of becoming e-sports masters, but the reality is that only a handful of players at the top of the pyramid can "kill one person ten steps at a time, leaving a thousand miles behind", and more people can only be unknown.

By 2023, the profession of online writers is unfamiliar and familiar to most people. We have read online writers more or less, and the legend of online writers has never stopped, but it seems that in real life, we haven’t met many people who are online writers.

Probably, it’s because once a net writer doesn’t have a uniform like a white coat or a red vest, the work of a second net writer is done in front of a computer, so there is no need to contact people in reality.

In fact, according to the previous public data of China Audiovisual and Digital Publishing Association, the number of online authors in China has exceeded 20 million. In the first half of 2022, Reading Group added about 300,000 writers and 600,000 works, with an increase of 16 billion words.

On social media, the discussion of online writing and entry skills has also increased. According to third-party data, Xiaohongshu adds more than 200 notes related to online writing and introduction every month, with an annual reading volume of over 10 million.

Why does the group of 20 million net writers seem to have less sense of existence than the group of more than 4 million doctors and 17 million teachers?

The answer is a key word: sideline.

From a certain point of view, the author and the actor are similar, and there is a kind of "performance". Some small fresh meats are either paralyzed all the time or hysterical, showing no acting skills, just like some authors wrote "The First People’s Hospital of Los Angeles" and "Wake up from a 500-meter-long bed every day", which are the results of lack of life experience and lack of relevant knowledge.

Of course, an excellent author can make up the online world where it is difficult to distinguish between true and false. Here, the firm but gentle is vertical and horizontal, and idolize is month by month, and the so-called sincerity is the killer skill. If the police write detective stories, forensic doctors write evidence, and officials write officialdom, it will naturally be more handy and allow readers to be there.

The 2022 Report on the Development Trend of Realistic Internet Literature shows that most of the authors come from 57 categories of national economic industries, such as education, health, internet and related services. Although they are part-time writers, they have created as many as 188 professional images in their works, such as the police in Captain Detective, the communication engineer in Dancing with the Cloud, and the internet operation in Smart Travel Elite, all of which come from their personal experiences.

Hexiao, a mother of two children, has a rich professional experience. As a sideline writer of realistic themes, she has also achieved remarkable results. In this sideline, she has published more than one million words, published a children’s literature "Legend about My Sister", and her masterpiece "Biography of Shanghai Mortal" won the first prize in the 6th essay contest of realistic themes online literature of Reading Group.

She told Ai Faner that the reason why she took online writers as a sideline came from "loneliness and desire to talk":

At that time, I was pregnant and rested at home. Every day after my husband went out to work, I had ten hours to spend alone. I don’t know where I learned the precepts of pregnancy and followed them devoutly, so I automatically filtered out sports, TV, eating, drinking and having fun. I sat by the sofa, and there happened to be a newly bought notebook on the mobile desk. When I opened a document, my original intention was to record the growth of a fetus, and then I thought, it is better to write a prequel and record the love of his parents. As a result, my first book, Love Record of Magic Capital, which was only shyly shown to a few people, was born. Thanks to a few people and their enthusiasm and encouragement, I really walked on the road of online writers in the next few years.

There are not a few people like He Xiao who started to write online articles on a whim, but not many people can persist through the funnel of time and perseverance. He Xiao’s sideline is not smooth, and he will encounter difficulties as well. How to allocate time with occupation and life, how to deal with time conflicts and how to overcome the idea of breaking shifts are common problems for people who regard net writers as sideline businesses, including He Xiao. He Xiao said:

When I saw such words as "lack of energy, time conflict, and want to break the clock", I felt inexplicably guilty and always suspected that my editor was taking the opportunity to give me a blow.

The above state is indeed the state I often face when I write "Weekend Couples". At that time, the main business I was engaged in was facing an industry inspection, which was related to the economic subsidies for the next two years. The boss took the lead in working overtime, and employees like me had to accompany me. Even if Lu Xun really said that time is like water in a sponge, I really can’t squeeze it out. Hard squeeze can only be deducted from sleep time. The guaranteed daily update of 4,000 words was forced to be changed to 2,000 words. Sometimes there is no time code for 2,000 words, while standing with your eyes open, you can’t help but retreat, thinking, it’s not a big shot in the net, so what’s wrong with breaking it?

The idea of breaking more lingered in my mind, but it didn’t really break in the end. This is also what I am proud of-we are a person with a sense of responsibility and mission. The difficulty is to test the stone. Only a determined person can pass the test. Writing is my determined hobby.

This will is also what she thinks is the biggest gain from the sideline of online writers. Besides income, it is this will and action that gives her the greatest confidence in educating her children. Example is greater than words:

The way I go to bed late and get up early every day to write, the way I bring back a stack of books from the library to read and look up information, and the way I board the first prize podium of the sixth realistic online literature essay contest of Reading Group will affect my children silently.

He Xiao’s journey as an online writer may have some contingency, but it has certain inevitability here in Qianliying (pen name). She is the winner of the most popular prize in the second Greater Bay Area (Shenzhen) Online Literature Competition, and also the CEO of an enterprise.

She said to Ai Faner:

People who choose to be online writers are all interested in words, right? Or it won’t start. That’s the same as all hobbies: if you don’t do this, you will feel that the day is incomplete.

One of my goals in life since I was a child was to write a novel in my life. One day in 2019, I opened the backstage of the writer’s assistant, and when I saw the realistic theme essay, I started to work, and I never wanted to stop.

When talking about the advantages and disadvantages of becoming a part-time online writer, Qian Liying and He Xiao’s first reaction is "to advance and attack, and to retreat and defend", but they also believe that sincerity and love are the driving force to go further. After all, compared with part-time jobs with stable income and controllable expectations such as convenience store clerks, the competition among online writers is more intense and the expectations are more uncontrollable. Some people earn a golden house in Yan Ruyu, while others leave empty-handed. Therefore, Trinidad Eagle commented on the advantages and disadvantages of online writers like this:

The advantage of being an online writer is "like and bury the possibility of being popular", and the disadvantage is that from the perspective of income, the great probability is "busy for nothing".

From all angles, it is not an easy thing to regard online writers as a sideline. Getting started requires certain writing skills, persistence requires long-term love and firm will, and success depends on the probability.

However, from the perspective of personal acquisition, Qianliying belongs to the crowd that does not value money income, and the sense of existence of "having been here" is what she values most:

Every era must have a recorder, so I insist on writing realistic themes, recording the marks left by people belonging to our era, and creating possibilities for future generations to discover one day.

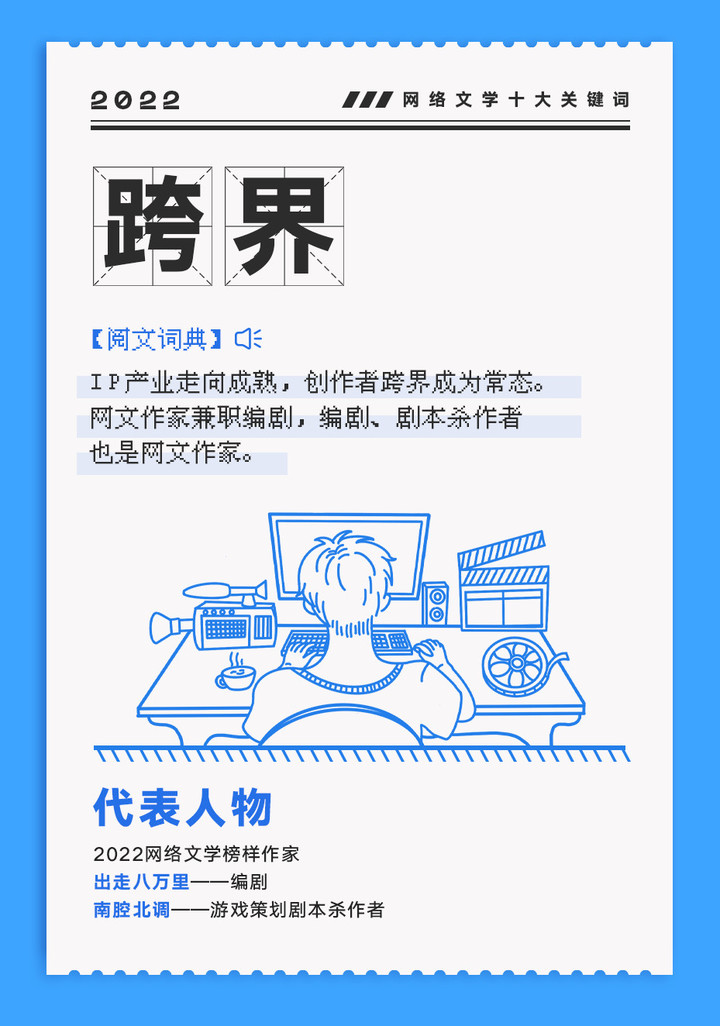

Together with the keyword "sideline" mentioned earlier, "cross-border" is also one of the top ten keywords of online literature in 2022 released by the surging and reading group.

In many film and television works adapted from online texts, the original author is often listed in the screenplay column, sometimes out of respect for the original work, and sometimes the original author does participate in the screenplay work.

However, in recent two or three years, it has its own particularity, and the film and television industry and the script-killing industry have been hit hard, so many screenwriters and script-killing writers have come to the online world in the opposite direction and become online writers. As a weather vane, in the qidian 2022 Twelve Kings selection results, he was a screenwriter before leaving 80,000 miles (pen name); Nanqiang North Tune (pen name) used to be a game planner and script killer.

Running away from 80,000 Li is the first graduate of Zhejiang Media College majoring in drama, who has experienced the prosperity of the film and television industry and survived the difficult period of the industry by relying on the transformation of online writers.

Similar to He Xiao, it is a bit accidental to leave 80,000 miles to go online. In 2020, because of the epidemic, the drama was rescheduled for two years, and he was trapped in his home in Hangzhou for a long time out of thin air, and his anxiety gradually spread. So, as a senior reader of the net text, he ran away for 80 thousand miles and began to create the net text.

Even though he was a professional and experienced writer, it was not smooth sailing from the screenwriter to wait for him, and the test work "I use idle books to become a saint" was rejected one after another.

When a screenwriter writes a script, there will be corresponding pictures to present the plot together, but there are only words in the online text, and there is a huge difference between them. At the submission stage, a version of "I use idle books to become a saint" will be very wonderful if it is placed in a film and television drama, but if it is online, it will make readers unknown so.

After many revisions, "I became a saint with idle books" was finally put on the shelves and finally exploded.

In the process of creation, some of the writers’ methodology also helped to run away from Calvin’s predicament. The creation of online texts is both physical and mental. Under the high-intensity update, it is very difficult to ensure the plot to advance and the rhythm to be carefree. It is very easy for the author to encounter creative bottlenecks. Unlike most people who create online articles alone, the work mode of screenwriters is brainstorming. Whenever Calvin leaves, he will communicate with his peers and readers and broaden his mind.

At present, he still keeps his job as a screenwriter after leaving for 80 thousand miles, but he has also begun to decide to focus on the creation of online texts and reduce the workload of screenwriters. For him, the balance of the main business and sideline has tilted to the other side.

In the interview, Trinidad Eagle mentioned:

Professionalism in writing can already realize personal commercial and social value. I admire the writers who have reached this point, and I hope I can become such a person one day. Who doesn’t want to change from an amateur to a professional?

Regardless of sideline, cross-border, or full-time, in essence, online writer is a real career, even if the production results are online.

▲ Electronics factory workshop

Different from the white-collar workers or gold-collar people mentioned above who devoted themselves to the creation of online articles, Song of Thorns (pen name) chose to work in an electronics factory in Guangdong after graduating from high school in 2008, working at least 10 hours a day and at least 6 days a week. With such hard work, the monthly income is only two or three thousand yuan. Under the high-intensity work, reading online texts is one of her few leisure ways.

Then, in 2015, Song of Thorns returned to her hometown in Henan from Guangdong, and began to engage in beauty-related work. The fragmentation time also increased, and she also changed from a net reader to a net author. Unlike most web writers who sit in front of a computer to create, Thorn Song didn’t have its own computer when it started, and the writing tool was a mobile phone.

The first work "Counterattack with a System" is closely related to my own beauty work, but Song of Thorns, who was only trained in school writing, is not an excellent author at this time, and her work has not produced much influence.

At this time, a reader who found fault with her work and got a positive response rewarded 200 yuan, which made Thorn Song begin to realize that his work was valuable. By the end of 2016, when her second work "The Story of Youth" began to be written, the income of Thorn Song began to rise.

By the middle of 2017, her income was enough for her to buy two small houses in her hometown in Henan, one for her parents and one for herself.

Today, the total writing of Thorn Song is close to 10 million, and it is a senior writer with female frequency as the starting point. The leap from a migrant girl in the south to a high-income online writer may be an inspirational template for many people to devote themselves to it. Of course, there are reasons for their incessant writing, but Thorn Song believes that it is the only way to maintain the continuity of creation by seriously experiencing life and reading and thinking all the time.

Just as her first work is about beauty, Thorn Song’s advice to beginners is to write about their own life experiences, or to enlarge them by knowing more aspects, and then weave some materials to describe them, which will be more realistic. Secondly, there will not be too many bugs that some readers don’t like, and they will gradually improve their control over writing.

The working experience of Thorn Song exists in her works in the form of fictional adaptation, and she had a period of orthodontics and a lot of food restrictions, which also became the driving force for her to write about food: she wanted the characters in the book to taste all the food instead of her.

One of the small worries of Thorn Song now is that she loves to grow flowers, and she is considering writing a Xianxia novel related to growing flowers, but she has no good inspiration and can only put it in the theme to be written.

Lalalin, editor-in-chief of the Reality and Short Channel of Reading Group, noticed that online literature has developed for more than 20 years, with a variety of themes and a lot of works. The theme of fantasy crossing and repairing truth is enduring and the competition is fierce. In addition, there are also new trends. From the recent film and television market, especially from the trends and changes of the East Asian film and television market, there are a large number of films and television works with special themes based on the realistic background, such as combining social suspense, criminal investigation, social problems, women’s themes, etc., among which a large number of explosions appear, and these works can be regarded as the realistic theme background in the theme classification.

In the field of online literature, the overall development of realistic theme is slow. On the one hand, it is subject to the theme cognition, and many authors will define realistic theme as the main theme, which is difficult to control. On the other hand, the realization mode is relatively special and it is relatively difficult to succeed in the subscription market. However, realistic themes have a lot of commercial realization value, such as physical publishing and film adaptation. The novel length of several hundred thousand words required further reduces the cost of creation time, and the overall income is not low.

Whether it is the first step to find a sideline writing from a novice or the blue ocean field of creation, reality is a key word that can’t be bypassed. The assertion that art originates from life and is higher than life still applies here.

Even though the first work went 80,000 miles away, the inspiration and core setting of "I Become a Sage with Casual Books" still originated from his college major, interest and career direction.

▲ stills of the movie "The Story of the Boat"

To some extent, becoming an online writer is not an option to make quick money. Winners are like the song of thorns, and the first year is also very bleak, but writing is not only the present time, but also their own life experiences for many years.

Therefore, when it comes to what foundation and ability are needed to become a part-time online writer, Lalalin thinks that besides qualified narrative skills, the first condition is a very strong creative consciousness. Because part-time creation needs to squeeze a lot of the author’s life time, especially in online literature, because of its long serial nature, it is even more necessary for the creator to invest a lot of energy in creation and conception every day. At this time, if there is no self-discipline and consciousness in creation, writing may not last long without the initial creative impulse.

As a sideline and even a career choice, online writers can actually be divided into two types. In Lalalin’s view, many practitioners in Fengkou industry have a life choice, and they don’t necessarily want to take creation as the main source of income. For example, the authors of Dancing with the Sand and Dancing with the Cloud, which are based on the novel prototype of Huawei engineers, have the conditions and opportunities to create and participate in online literature after years of precipitation in related industries.

There are still many people who are engaged in traditional industries, and their income may not be high. The income from online literature creation can indeed provide them with better material living conditions and even provide another possibility of life.

In the end, whether it is sideline or cross-border, or respect for reality or path choice, it still boils down to one key word: life.

Even if I become a full-time writer, I think I still have to have a life and accumulate materials in my life,’ said Qian Liying, an online writer. Lalalin, the editor of the net, said that part-time creation needs to squeeze a lot of the author’s life time. He Xiao, running away for 80 thousand miles and the song of thorns all prove that writing without life accumulation is a castle in the air.

Is it contradictory?

In fact, there is no contradiction. When you are determined to become an online writer, it is actually the beginning of respecting life. What is compressed is the original wasted part.

▲ The title picture is a stills of the TV series "Beginning"