Last week, rumors of Didi buying Uber China spread one after another. Yesterday, the news was officially confirmed. Didi Chuxing announced yesterday that it will acquire all the assets of Uber China in the Chinese mainland, including brand, business, data and so on. At the same time, Uber China will become the largest shareholder of Didi, holding a 20% stake in the merged company.

Yesterday, Didi Chuxing announced a strategic agreement with Uber Global, and Didi Chuxing will acquire Uber China’s brand, business, data and other assets to operate in the Chinese mainland.

event

Uber China will become Didi’s largest shareholder

After the strategic agreement, Didi Chuxing and Uber Global will hold each other’s shares as minority shareholders. Uber Global will hold a 5.89% stake in Didi, equivalent to a 17.7% economic interest. Uber China will acquire a 20% stake in the combined company and become the largest shareholder of Didi Chuxing.

In terms of human resources, Cheng Wei, founder and chairperson of Didi Chuxing, will join Uber’s global board of directors. Uber founder Travis Kalanick will also join Didi Chuxing’s board of directors. At the same time, the two teams will be integrated by Didi, sharing resources in user resources, online and offline operations and marketing and promotion.

In terms of operation, in the future, Uber China will maintain the independence of its brand and operation, which means that Uber’s brand and system will not disappear, and drivers and passengers can still use the travel services provided by Uber. At the same time, Didi Chuxing said that it will advocate internal competition and mutual promotion. Didi said that in the future, it will launch more refined and diversified services to meet consumers’ increasingly rich travel needs and continue to increase drivers’ income. This means that in addition to the functions currently provided by Didi such as special cars, taxis, ride-hailing, chauffeur driving, test driving, and public transportation, Didi will also launch more forms and content services in the future.

Cheng Wei, founder and CEO of Didi Chuxing, said that in the past two years or so, Didi Chuxing and Uber have been competing and learning from each other in the field of innovation in China. As a technology leader rooted in China, Didi Chuxing hopes to continuously promote technological innovation and change the future of human transportation. The cooperation with Uber will enable the entire mobile transportation industry to move towards a healthier, more orderly and higher-level development stage.

reason

Why did Didi and Uber merge?

Management compromises with capital markets

According to foreign media reports, the merger is led by investors from both sides. At present, the two sides have BlackRock, Hillhouse Capital, Tiger Fund, and China Life. Four joint investors, especially Tiger Fund and Hillhouse Capital, which are both investors, play a crucial role in it. It is not so much that Uber’s global management chose to end the war in the Chinese market through the merger, but rather to compromise with capital markets in order to protect its global business. Uber previously planned to invest another 1 billion US dollars in the Chinese market to "burn money", but investors blocked this plan. Uber’s investors hope that the management will end the costly battle with Didi in China. According to reports, Uber’s founders initially opposed the merger plan, but eventually had to compromise with investors.

No matter who is leading, the move is intended to end the "cash burning" of both parties, especially Uber China, while also helping Uber China better integrate into the Chinese market is a common view in the industry. In an open letter yesterday, Uber founder Travis Kalanick said: "As an entrepreneur, I have learned that success is not only about following your heart as much as possible, but also trying to follow your reason. Continuing to provide services to Chinese cities and drivers and users who depend on Uber is only possible if it is profitable." This represents Uber’s current state of continuous loss and cash burning, which is also the most important reason for the merger.

Can’t Uber China’s money burn?

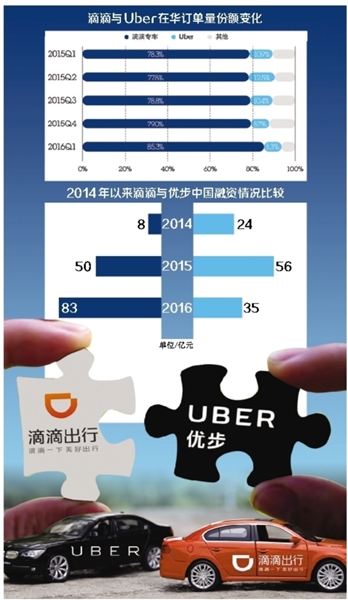

Wang Ruchen, an Internet analyst and founder of Quark Media, said that Uber can no longer burn money in China. Uber and Didi have invested a lot of money to compete in the development of the past few years. At the current stage, they have burned several rounds. Since June 2014, they have raised a total of 11.50 billion yuan. Investors are facing the problem of liquidity, so "shaking hands and making peace" is inevitable. At the same time, there is also a very important reason. The current situation and problems encountered by multinational Internet companies in China are actually more than they imagined before entering China. Foreign companies believe more in the penetration of technology and systems, but in fact, the Chinese market needs more manpower, landing, implementation, etc. When Uber first entered China, it had a team of less than 10 people. Now, although it has grown to 800 people, its ability to reach offline is still very weak compared with Didi’s 5,000 people. In the future, cross-regional development will have cross-regional integration, which is a trend and inevitable.

Internet observer Luo Chao said in an interview with the Beijing Youth Daily reporter that Uber’s poor performance in China is an important reason. Very few international giants have succeeded in localizing in China, and Uber is no exception.

Ride-hailing guidelines put pressure on Uber China

Last week, the "Guiding Opinions on Deepening Reform and Promoting the Healthy Development of the Taxi Industry" and "Interim Measures for the Administration of Online Booking Taxi Business Services" were promulgated. Online car-hailing became legal, which means that Didi, which has implemented the policy of "affiliated operating company", is the biggest beneficiary of the new policy. Uber China, which has always been connected to the platform by private cars, obviously needs to change its business model to better adapt to the new regulations, which also brings a lot of pressure to Uber China. In its response yesterday, Didi also said that Didi will work closely with regulators to continuously cultivate the market; create a healthy and orderly industry ecology, and make more positive contributions to China’s economic growth and employment transformation.

impact

"Suspected monopoly" is mentioned again

After the merger of the two, what will be the impact on the travel sector? Analysys analyst Zhang Xu believes that the current active user coverage of Didi Chuxing and Uber China in China’s private car market occupies the top two positions respectively. After Didi Chuxing acquires Uber China, the private car market landscape will usher in great changes, oligopoly will be further enhanced, and market competition will enter a new stage. For other private car manufacturers, competitive pressure will further increase, and force competing companies to accelerate product and service innovation to increase user volume and enhance existing active user stickiness.

The oligopolization of the special car market is imminent

It is also reported that Didi and Uber China have not yet declared their merger intentions to the relevant departments. Previously, other competitors raised the issue of "suspected monopoly" during the merger of Didi and Kuaidi, but Didi responded at the time that the market share has not yet reached the monopoly requirement. Now that Didi is growing bigger and bigger, the term "suspected monopoly" has been mentioned again.

In this regard, Zhang Xu believes that the market that the two have penetrated is a completely competitive market. In the Chinese car market, in addition to Didi Chuxing and Uber China, there are still many players such as Yidao, Shenzhou Special Car, and Shouqi Car-hailing, and all places are eager to try to establish local online car-hailing platforms. Take Yidao and Shenzhou Special Car as an example. In the past year or so, they have invested a lot of energy and have also pulled up a lot of orders for them in terms of increasing subsidies and expanding users. That is to say, in this fully competitive market, each company has considerable strength. In the face of so many competitors, no one dares to cancel subsidies and raise prices lightly. But at the same time, the penetration rate of private car travel among urban residents is still at a low level. After Didi Chuxing acquired Uber China, it still needs to invest a lot of resources in the private car travel market to carry out "Internet +" reform of traditional travel. Didi Chuxing’s acquisition of Uber China has not yet formed a monopoly situation, but the oligopoly of the private car market is on the horizon.

China Car Rental shares fell nearly 4%.

But there are also opposition voices that believe that the merger of Didi and Uber China will undoubtedly be a huge loss for users. Internet observer Ge Jia told the Beijing Youth Daily that the merged company will control the vast majority of the online car-hailing market, forming a de facto monopoly pattern, and then choose the opportunity to use this monopoly position to pose a threat to the interests of ordinary users.

The monopoly of private car service is different from the monopoly of ordinary business. It is a business with public attributes and has a strong public service nature. I hope the regulatory authorities can deeply understand the difference between this merger case and previous cases. In the approval process, they will no longer be lenient. It is necessary to evaluate the possible impact on ordinary users in detail, and make their own final decision based on the choice to protect the interests of consumers. For consumers, monopoly is ultimately a bad thing. It is unrealistic to simply hope for policy supervision and protection. Always be prepared to vote with your feet is king.

Yesterday, after the news of the merger between Didi and Uber China broke, the newly listed China Car Rental fell by nearly 4%, which also represents the market’s panic about the potential monopoly of the transportation giant.

News Memory

Didi, Uber, and China all have Liu family members behind them

Didi and Uber China have another relationship. Didi’s president, Jean Liu, and Uber’s head of China strategy, Zhen Liu, are Liu Chuanzhi’s daughter and niece, respectively. The two are actually cousins.

At present, Liu Qing is the president of Didi Company and is the "second-in-command" of Didi Company except for Cheng Wei, the CEO. After the news of the merger between the two parties was released yesterday, Liu Qing and Cheng Wei jointly issued an internal letter to Didi colleagues. The letter mentioned that "great opponent, epic showdown" is an evaluation of Uber, which can also be regarded as an evaluation of Uber’s leadership team.

Liu Qing was born in 1978, with a bachelor’s degree in computer science from Peking University and a master’s degree from Harvard University. Her father was Liu Chuanzhi, the founder of Lenovo Group, but she did not enter Lenovo’s job. It is said that Liu Chuanzhi once stipulated that "children of Lenovo management shall not work in the company". In 2002, Liu Qing joined the investment banking department of Goldman Sachs; in 2008, Liu Qing served as the executive director of Goldman Sachs (Asia) Limited Liability Company, with an annual income of more than 10 million yuan. Among them, Didi is also the company that Liu Qing has always wanted to invest in on behalf of Goldman Sachs. In 2014, at the invitation of Cheng Wei, Liu Qing joined Didi as the chief operating officer. At that time, Uber was just about to enter the Chinese market, and Didi’s biggest competitor was Kuaidi.

On Valentine’s Day 2015, Didi and Kuaidi announced the merger, which was one of the main events led by Liu Qing at Didi. In the same month, Liu Qing was promoted to president of Didi. Cheng Wei said, "Liu Qing helped the company complete the largest financing of 700 million US dollars for a non-listed company in half a year when he joined Didi, and led the special car, PR (public relations department), and GR (government public relations department) teams to fight bloody battles, blazing a bloody path, and started a future-oriented organizational change in the personnel field. After serving as president, Liu Qing will be more responsible for the daily business operations of the company."

Liu Zhen is Liu Chuanzhi’s niece. She graduated from Renmin University in China and studied at the University of California, Berkeley. After working in a law firm in Silicon Valley, she was sent back to China in 2008 to represent Silicon Valley companies in some investment work in China, mainly in charge of legal advice for Internet companies, and Uber is her client. In early 2014, Uber entered China, and in August 2015, Liu Zhen made her first public appearance as the head of Uber China strategy. Since Uber China does not have a CEO, Liu Zhen is called the "first sister" in Uber China.

The previous rivalry between Didi and Uber was seen to some extent as a showdown between the two women of the Liu family. When news of the merger broke, some netizens said that "Erliu can finally meet and chat happily".

Does Liu Chuanzhi have any objections to his cousins as the first and second leaders of two travel giants? Previously, Liu Chuanzhi responded positively to the question in an interview with the media, "The specific issue of the child is rarely discussed. I am not as supportive or unsupportive as the outside world said. I did not stop it. My wife is clearly opposed." In addition, Lenovo is also a major shareholder of another travel platform, Shenzhou Car Rental. Is this accidental or arranged? Liu Chuanzhi said, "It is all accidental. Liu Qing and Liu Zhen both chose their own careers, and they have nothing to do with me at all. In terms of enterprises, I should pay more attention to Shenzhou Car Rental. After all, this is invested by Legend Holdings. Everyone is running for the development of their own careers, so there is nothing."

Text/Our reporter, Wen Jing, graphic production/Pan Fan