Original, Wang Yaqi, e-commerce online

Text | Wang Yaqi

Editor | Sask

At the moment of the epidemic, the fire of community group buying has begun to burn again.

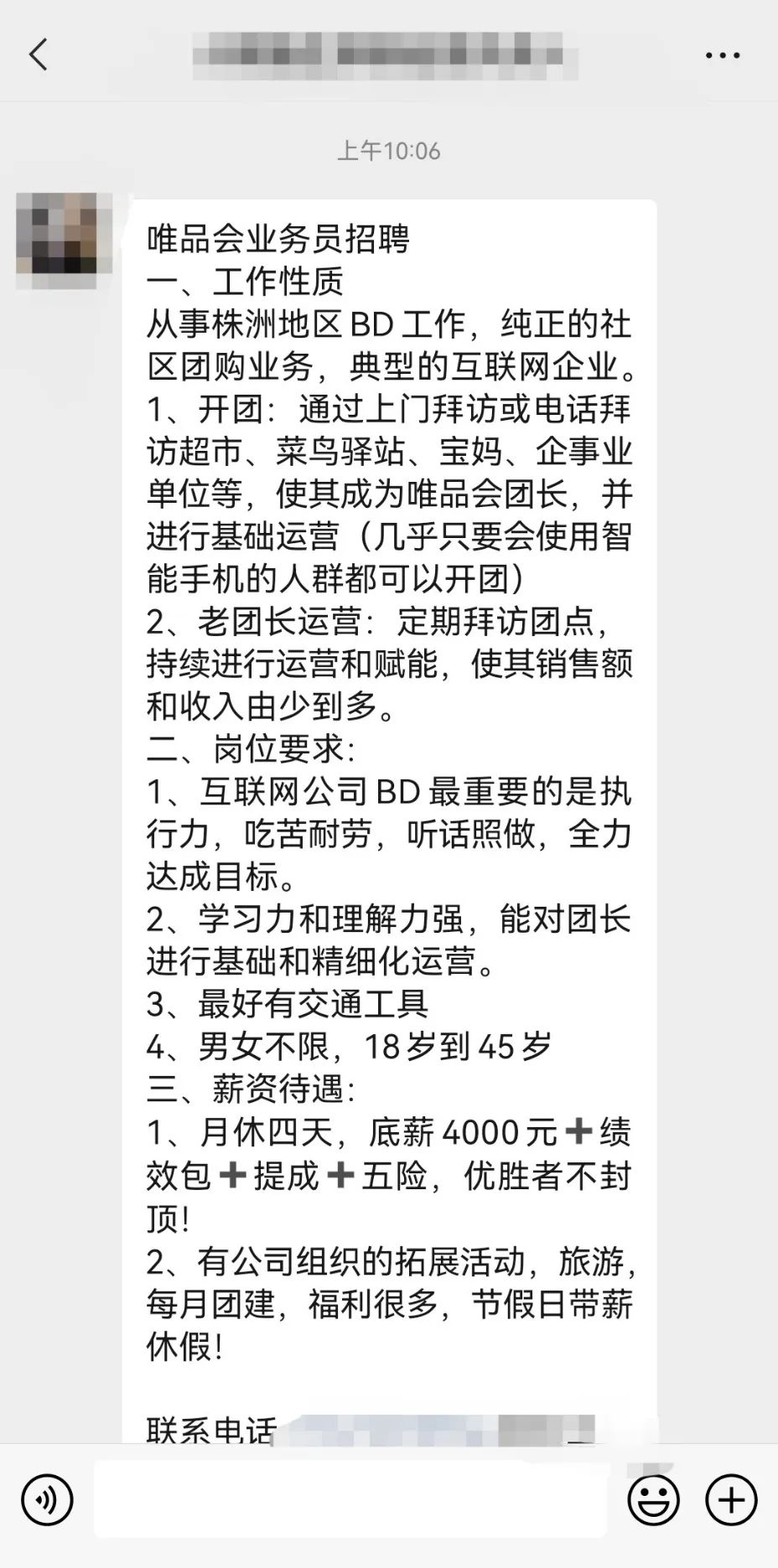

Recently, it has been reported that Vipshop is recruiting a head of delegation in Zhuzhou, Hunan. Judging from the recruitment information disseminated, the first to recruit is the investment promotion staff (BD) – in addition to expanding the position and developing the head of delegation, the job content also includes assisting the head of operation and revenue, and the position treatment is calculated according to the basic salary of 4000 + performance + commission. BD is often the prelude to building the business and team, but on the major recruitment platforms, there is no official recruitment information for the time being, and this recruitment is more likely to be carried out quietly.

As an e-commerce platform that swipes TV screens all year round, takes clothing as its core category, and has a stronger "sale" mind, Vipshop and community group buying are connected in tandem, which at first glance is very inconsistent. But it is reasonable to analyze the business model. Vipshop has always wanted to cut from vertical categories to all categories, but the "lack of traffic" has always stuck its transformation lifeline. Even in 2017, Tencent and JD.com announced their investment in Vipshop, and Vipshop sales entered WeChat Jiugongge. The continuous supply of traffic from Tencent’s social products still failed to solve the anxiety of Shen Ya, the founder of Vipshop.

In the field of e-commerce, the division of online traffic has been basically stable, but offline traffic has not yet been fully penetrated, and there is still a chance to take a chance.

Community group buying is considered to be the hottest track in 2020, but this year, there have been subtle changes:

1. Compared with the "first day order and next day pickup" recognized by the industry in the previous two years, the model of community group buying seems to have returned to the essence of the original "group buying", a model of making a fortune from a private domain;

2. Regional and local groups have begun to thrive again, and even now it is a personal group – through tools such as Kuaituan, anyone can not be attached to a certain platform, become a leader, and enter the community e-commerce;

3. From high-frequency fresh food to daily general merchandise, consumers who have been cultivated are no strangers to group buying and even demand more.

The change of the competition landscape and the maturity of consumption habits have increased the "probability" of Vipshop’s community group buying. However, when Tongcheng Life, Food and Enjoy Club, and Shihui Group fell one after another, the orange heart selection and prosperous selection that brought capital into the game frequently contracted, and Duoduo Shopping and Meituan Preferred continued to lose money. The industry does not seem optimistic about Vipshop’s rash entry. In the second half of the increasingly complex industry, Vipshop up the ante may be a risky move, but it may not be a breakthrough.

"Group buying seniors"

Vipshop is not a traditional e-commerce platform. It first started by relying on "special sales" – it was more often called "flash sales" in the early e-commerce field. It is in the form of limited-time sales, regularly launching products of internationally renowned brands, at a discount of 1-50% from the original price for exclusive members to snap up for a limited time. This was a strong market demand a decade ago when there was a serious overcapacity in apparel: according to wind data, among the 87 listed companies in the textile and apparel industry, the cumulative inventory reached 73.20 billion yuan in mid-2012.

However, when the inventory dividend resources gradually dried up, the core competitiveness of the flash sale model was weakened. Vipshop’s competitor VANCL also launched flash sale, and the commission ratio was lower than that of Vipshop; Dangdang quickly launched "tail exchange", and the intention of challenging was obvious; not to mention JD.com and Tmall also launched their own special sales channels. For Vipshop, which started flash sale, the industry volume of flash sale is not as good as that of traditional e-commerce, and whether it is the supply chain or the self-produced traffic level, Vipshop cannot compete with the comprehensive e-commerce platform.

In such an industry context, there is neither stable goods nor closed-loop in-app traffic, and accurate consumer groups have become Vipshop’s final weight. Getting more external traffic and becoming the head of the vertical industry have become the key to Vipshop’s competition, and it has also become an opportunity for it to target group buying.

In 2012, at the height of the PK battle, Vipshop officially tested the "group buying" model. The essence of group buying is group shopping, which uses social stickiness to gather more consumers – that is, traffic, which is exactly what Vipshop needs. Vipshop set up the group buying channel "Vipshop Group" at that time, which made a distinction from the main category of clothing of flash sale, mainly engaged in daily necessities, including cosmetics, home improvement, accessories, snacks… However, by the third quarter of 2014, Vipshop began to shrink the group buying business. By the second quarter of 2015, the group buying revenue contribution had been reduced to 0.2% of the total quarterly revenue, compared to 5.5% in the same period last year.

Vipshop is now very rich in categories

In this regard, Yang Donghao, then the CFO of Vipshop, once explained that the unit price of the group buying business was only half of the company’s main business, but the company still had to pay for the delivery of each group buying order, and the profit margin of the group buying business was much lower than that of Vipshop’s main business. Considering the low unit price of the group buying business, there was also a certain gap between the repurchase rate and the sale, so the operation was adjusted – Vipshop’s first group buying test started with external traffic, and finally did not make money, and finally gave way to the company’s short-term revenue indicators.

In the fierce competitive environment at that time, it was difficult to say that this was a wrong move. But a few years later, Vipshop was still worried about traffic, and its motivation for entering the group buying market was still there. The change was that the giants who had entered the market in the past two years had already used their money to develop their consumption mentality and market education. When consumers began to pay for group buying, Vipshop’s sales crowd that had accumulated for several years became a valuable asset. It was so similar to the label attributes of the group buying crowd that it was not surprising that Vipshop, a veteran with the "group buying gene", chose to leave the market again at this time.

Fresh food e-commerce has long been deployed

Nowadays, when we talk about community group buying, it seems that "placing an order on the first day and picking up the goods the next day" has been taken as a definition. Duoduo Shopping, Meituan Preferred, Amoy Vegetables… have all strengthened the "fresh" label for it. And the "old three groups" of community group buying: Tongcheng Life, Prosperity Preferred, and Shihui Group, were first ordered in the WeChat group to pry the private domain, and then became a platform. In a track with a very diverse business model, community group buying, which was born out of "group buying", is essentially still in the category of social e-commerce.

In the past few years, Vipshop has focused its attention back on specials, but it has always been obsessed with social commerce.

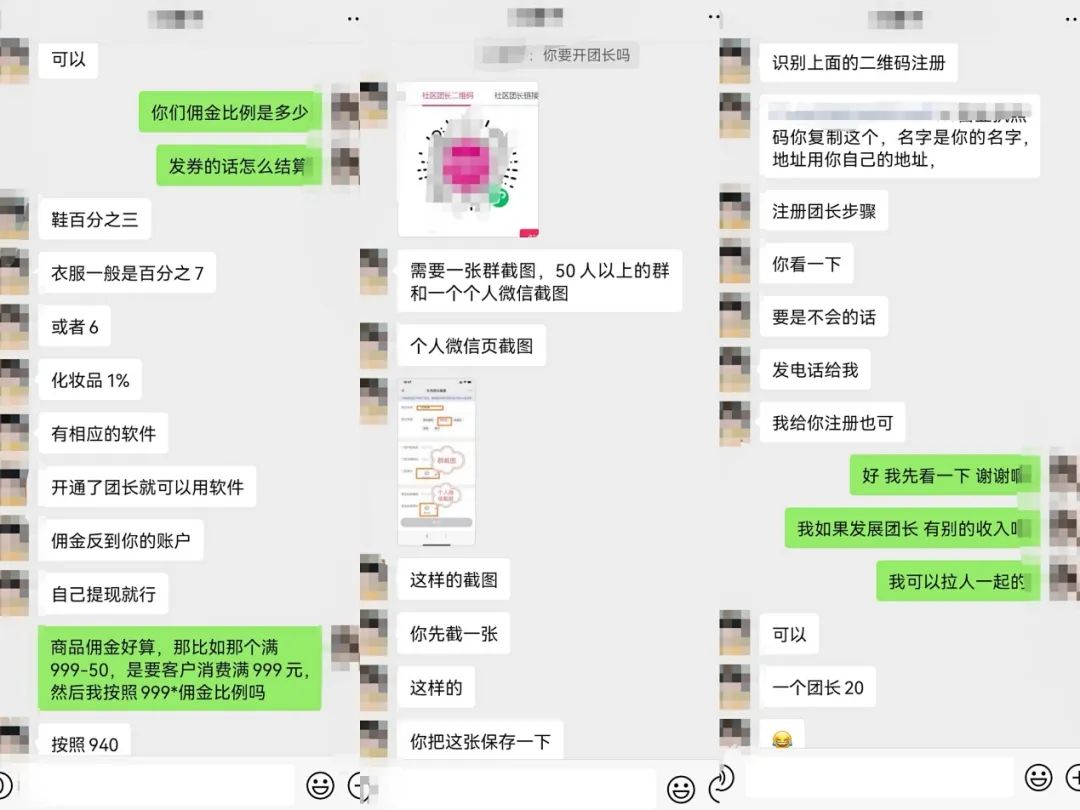

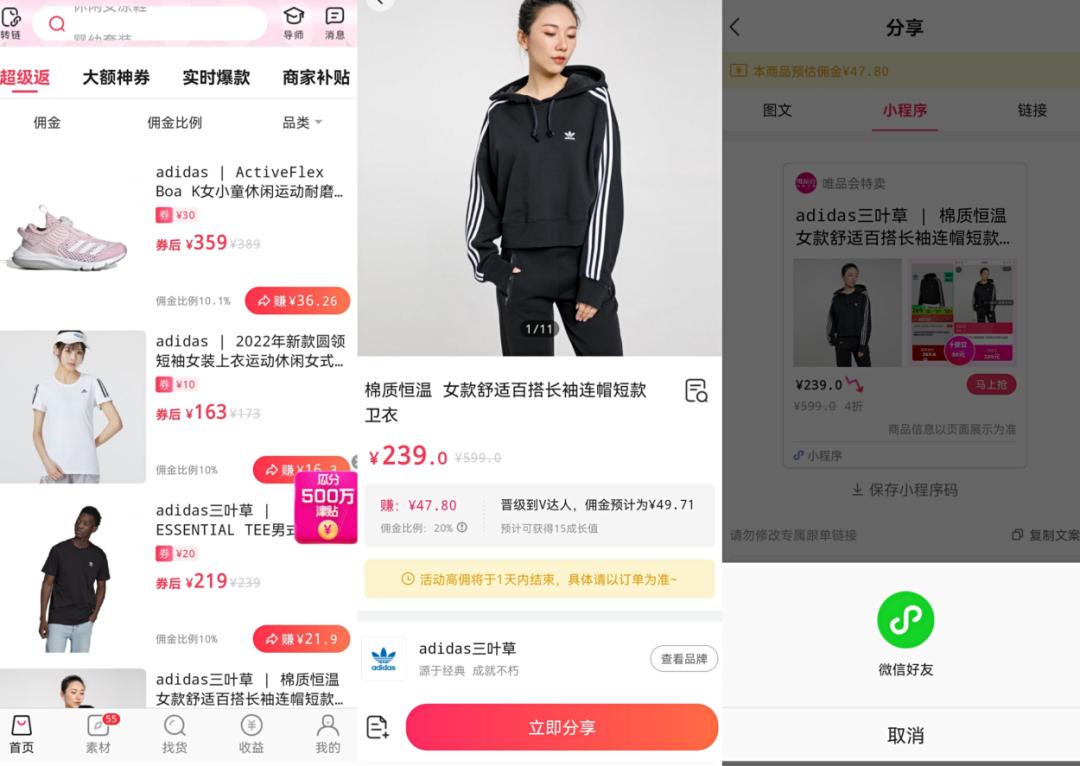

Opening Xiaohongshu, it is easy to be confused by the message "Recruiting Vipshop community leaders and university leaders" – although both are called leaders, the functions of the leaders here are not similar to those in community group buying. One leader told "E-commerce Online" that after becoming a leader, you can "issue coupons" or "send links". "All Vipshop products can be sent, and consumers can get commissions when they place an order. In terms of commission ratio, shoes are 3%, clothes are 6-7%, and cosmetics are 1%. Take a coupon over 999 yuan minus 50 yuan as an example, customers can get 949 * commission ratio income." In addition, if a new leader is recruited, the old leader can get a maximum of 355 yuan recruitment income.

Unlike group buying, Vipshop launched the Mini Program and APP "Only Enjoy Customer" in 2015, which is the above-mentioned "secondary distribution + Mini Program" logic, which is actually more similar to Taobao customers. It does not need to "form a group", but distributes rebates. The same as the traditional group buying model is that they all rely on private domain groups. The head of the group has certain network resources and operational experience can also be reused.

At present, it is not clear how Vipshop carries out community group buying, but it actually has a lot of cards in hand.

The industry believes that Vipshop may adopt two models: 1. Community rebate model, not bound by the actual geographical location, through online sharing to users, successfully earn part of the commission; 2. Community head model, with the geographical location of the community as the coordinate, point-to-point offline laying, more similar to traditional community group buying, transferring the distribution and labor costs at the end to the head.

If the first model is adopted, the "distribution leaders" who only enjoy customers are ready-made resources, but because the offline geographical location of the leader and the members of his private domain group is not the same, the distribution cost of the goods is on the platform side, and the distribution location is high. If the second model is adopted, although it needs to re-expand and recruit the leader, it is more biased towards the "real-world friends economy". After the distribution is perfected, the sales situation will be more stable. Centralized order issuance, distribution costs are also lower than the former.

Weixiangke is actually a distribution app.

But no matter which model is adopted, Vipshop’s ultimate goal is to sell goods and precipitate traffic, requiring not only the head of the team, but also the cooperation of goods, logistics, and tools.

As early as 2017, Vipshop launched a fresh food project. In 2018, Vipshop launched a fresh community store "Pinjun Life" and set a goal of opening 10,000 stores in three years. At that time, Vipshop Fresh and Pinjun Life had been connected in the background, and consumers placed orders on Vipshop or Pinjun Life APP, which could be delivered to their door or picked up by the store. At the end of 2020, the investment company wholly owned by Vipshop invested in the parent company of "Vegetable Dongpo". Vegetable Dongpo focuses on fresh supply chain management and community group buying system technical services to help enterprises solve problems in the supply chain such as order, procurement, sorting, distribution, mall and operation background such as product selection, high-quality, marketing and other issues.

Judging from several cards, Vipshop is at least prepared, and it is more likely to choose the "Community Leader Mode".

Did the leaders buy it?

Tongcheng Life, Prosperity Optimization, and Shihui Group all started from the private domain, but in the end they all took the road of developing the platform. A contradiction that has been repeatedly mentioned is that the platform model is actually converting the private domain traffic of the head of the group into the public domain traffic of the platform. The pull between the head of the group and the platform always exists between the two.

A straightforward question is whether the new generation of group buyers, who are already familiar with group buying and have personal resources in their hands, still buy into the platform? Or, more pointedly, at a time when the supply of goods is so abundant, how much loyalty does the group leader have left for a single platform? "Anyway, it is a group. Instead of letting the platform charge me a commission, it is better for me to earn the money myself," said a group leader.

In the past 12 months, the other side of the community group buying head players have fallen one after another. Local and regional groups are becoming active again, and even individual groups are rising rapidly – a community group buying tool called "Kuaituan", Mini Program, is popular. It belongs to Pinduoduo and can help the head of the group to publish group buying, follow orders and asset details. According to relevant media reports, in June 2021, the GMV of Kuaituan was 2 billion yuan, and the internal expectations of Kuaituan were doubled to 4 billion yuan in November 2021. Kuaituan official claims that there are more than one million heads. At the end of February this year, Tencent also tested a group buying tool Mini Program "Goose Enjoy Group" on WeChat.

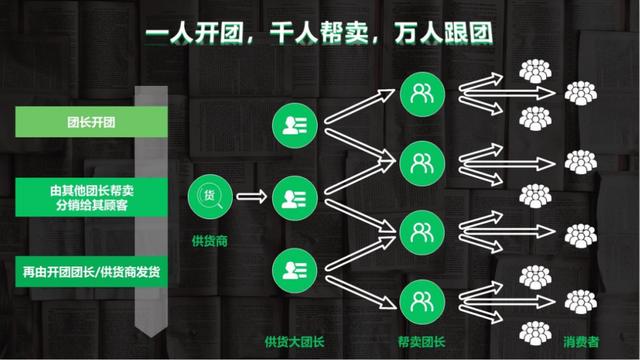

Fast Tuan Tuan mode, source: Cayman 4000

At this point, community group buying has begun to divide into two paths: the platform model and the head model.

The advantage of the head of the group model is that the growth is rapid, and the head of the group from all over the world can spontaneously open a group, which makes the cost of community group buying the original city opening and expansion point greatly reduced; but the head of the group model is not without disadvantages. Take the fast group as an example, it is mainly divided into the supply head, the big head and the small head. The supply head is often the brand owner and the distributor, and directly controls the product resources; the big head is the early purchasing agent and micro-business, and the network resources are rich; the big head can set the commission ratio and let the small head help sell – but in this process, the boundaries between the supply head, the big head and the small head are not clear, and the situation of the head of the group "rolling each other" is common.

Vipshop enters the market as a platform. At this time, when it gets involved in community group buying, it must first face the contradiction of "pulling between the platform and the head of the group".

The layout of the category is also a challenge: whether to put fresh food on the shelves? Fresh food is a high-frequency consumption, which has been verified by many platforms for excellent drainage effect, but its profit margin is limited, storage conditions are harsh and easy to wear and tear, which is different from the standard transportation of clothing and other products that Vipshop has always been good at. For Vipshop, the uncertainty of doing community group buying is still very high, which may be an important reason why the industry is not optimistic about it.

However, military risk tricks sometimes come out of the blue, especially in areas such as community group buying and social e-commerce. Running through the new model is still the expectation of the industry. Vipshop, which has been silent for a long time, wants to return to the center of the stage, and everything can only be clearer when its business surfaces.

Original title: "Another e-commerce company backed by Tencent, entering the community group buying"

Read the original text