Promote the stable and healthy development of the real estate market (Rui Finance)

Chao News Client Reporter Li Wenyao

On October 16th, at the 141st plenary session of the International Olympic Committee held in Mumbai, India, the IOC plenary session decided to adopt five new sports for the 2028 Los Angeles Olympic Games: baseball and softball, cricket, flag football, squash and tennis.

Earlier, International Olympic Committee President Bach said: "The choice of these five new sports is in line with American sports culture, and will show the world the iconic sports of the United States and bring international sports to the United States."

Official website of the International Olympic Committee explained that gender equality, the utilization rate of existing venues and facilities, and the popularity of events in the United States and around the world were taken into account in the evaluation of new Olympic sports.

There are three out of five items.

Appeared in Hangzhou Asian Games.

Among the five newly added events, except stick tennis and flag football, the other three events are official events of the Hangzhou Asian Games, and the China team also won the silver medal in the women’s softball event of the Hangzhou Asian Games.

Baseball and softball, cricket and stick tennis were once Olympic events. Among them, baseball and softball entered the Olympic Games from 1992 to 2008 and 2020, cricket appeared in the Olympic Games in 1900, and stick tennis was the event of the two Olympic Games in 1904 and 1908.

Although squash and flag football have never entered the Olympic Games before. But in the past two years, with the popularity of outdoor sports and the help of new media, it has become a new sport popular among young people after Frisbee, with a huge mass base.

Compared with the formal rugby, the waist flag rugby replaces the direct contact of the body by pulling the waist flag on the belt, which reduces the collision of the project itself, expands the audience of the sport, and makes teenagers and even girls happy.

Squash, which is known as the king of indoor sports, has entered college campuses and stadiums first. At present, there are about 30 squash courts in Hangzhou, including individual investment. These dozens of courts not only appear in national fitness facilities, but also can be seen in campuses and businesses, laying a good foundation for the public to understand squash.

Minority sports enter the Olympics.

Gain more attention

Compared with the other four events, stick tennis seems to be farther away from our lives. So what exactly is stick tennis?

Stick tennis, also known as net baseball, originated from the Indian tribes in North America, is a collective sport that uses the net pocket at the top of the bat to control the movement of small balls, and uses the lever principle to catch the balls in the net by throwing and scoring, and finally determines the outcome of the game by the score.

Does that sound familiar? Modern sports such as basketball and ice hockey, which originated in North America and are popular in the world, were actually invented with reference to stick tennis.

Stick tennis Source: vision china

In 1998, Beijing Sport University formally established the first male and female school team of stick tennis in China, and ten years later, it extended the sport to universities in Shanghai. At present, stick tennis is mainly carried out in universities, primary and secondary schools and sports training institutions in Beijing, Shanghai and Shenzhen, but there are no officially sponsored brand competitions in China because of the small number of participants.

These five events have officially become new events in the 2028 Los Angeles Olympic Games. For baseball and cricket, they are an opportunity to return to the Olympic family. For stick tennis, flag football and squash, they have entered the public’s field of vision, attracting more people to be crazy, just like cricket in the Asian Games.

In addition, according to the suggestions of international individual sports organizations, the IOC Executive Board meeting also confirmed the sub-item setting of the Los Angeles Olympic Games. Compared with the Paris Olympic Games, there is only one change: the beach sprint of coastal rowing, which has gradually become popular in recent years, has replaced the men’s and women’s lightweight double sculls. This is also the first time that rowing beach sprint has joined the Olympic Games.

"Reprint please indicate the source"

The default situation of credit bonds continues unabated. According to Wind statistics, as of June 30, the default scale of credit bonds this year has reached 98.573 billion yuan, far exceeding the level of the same period last year. Among them, the overdue principal of bonds is 91.338 billion yuan and the overdue interest is 7.235 billion yuan.

Insiders interviewed by reporters said that the deterioration of default data in the first half of this year was mainly due to the risk exposure of several major entities such as HNA Group and Huaxia Happiness, which can be said to be the result of the accumulation of default risks in the previous period. Looking forward to the second half of the year, the default situation may continue, and the credit differentiation will further intensify.

At the same time, with the gradual normalization of bond market default, the redemption rate of bonds after default has also decreased year by year. Although private enterprises are still the main force of default, the scale of default of state-owned enterprises has increased rapidly. According to statistics, in the first half of 2021, the balance of default bonds of local state-owned enterprises totaled 36.411 billion yuan, accounting for 79% of the default amount of local state-owned enterprises’ bonds last year, which continued to impact the "belief in state-owned enterprises". Some analysts said that there have been two major trends in the default of credit bonds. First, state-owned enterprises with weak qualifications will become a breakthrough to break the just exchange; Second, the tail real estate company will accelerate the market clearing.

The scale of credit debt default has expanded.

Since the beginning of the year, credit bond defaults have occurred frequently. According to statistics, there were 13 new issuers who defaulted for the first time in the first half of the year, including 7 issuers in the first quarter and 6 issuers in the second quarter. However, this figure is down from 19 in the first half of 2020.

According to the analysis of CICC’s collection team, in contrast, the cumulative number of issuers who defaulted in the first half of this year and in the two quarters showed a downward trend year-on-year. The decrease in the number of issuers who defaulted was related to the greater efforts of supervision and local governments to maintain stability, and repeatedly stated that they had zero tolerance for malicious "evasion of debts", actively guaranteed bond payment and restored market confidence.

Although the number of new defaulting subjects has decreased, the scale of default has not decreased. According to the reporter’s statistics, as of June 30th, the number of defaults on credit bonds reached 120 this year, with a scale of 98.573 billion yuan, compared with 94 and 72.995 billion yuan in the same period last year. Among them, the overdue principal of bonds this year is 91.338 billion yuan, and the overdue interest is 7.235 billion yuan.

"This is mainly due to the risk exposure of several major defaulting entities, such as HNA Group and Huaxia Happiness, which is the result of the accumulation of risks in the early stage." A director of fixed income of a fund company told reporters. For example, in the first half of the year, a number of issuers of Hainan Airlines were ruled by the court to accept bankruptcy and reorganization applications, and all the surviving bonds were deemed to be due to breach of contract, which in turn pushed up the number and amount of defaulted bonds in the first half of the year.

Ming Ming, deputy director of CITIC Securities Research Institute, also told CBN: "The scale of default under the conventional caliber includes the subjects that have defaulted over the years. If their surviving bonds expire in the first half of 2021, they will also be included in this year’s default, resulting in large data. In particular, the defaults in the first half of this year included large bond entities such as Kangmei, Huaxia Happiness, Huaxin and Taihe, which led to a higher amount than the same period last year. "

Mingming also said that considering the risk of default in the first half of this year, it is usually compared with the first default of enterprises. In the first half of this year, the new default was 8.65 billion yuan, which was lower than 13.38 billion yuan in the same period last year.

Real estate default accounts for a large proportion

From the perspective of industry distribution, in the first half of this year, bond defaults were mainly concentrated in comprehensive, real estate, air transport, construction and engineering industries. Among them, the default scale of the real estate industry was 19.192 billion yuan, ranking first. Some insiders predict that the market-oriented clearing will be accelerated in the future under the background that the real estate regulation is not relaxed.

CICC’s collection team believes that this is because real estate development enterprises have the problems of large cash inflow and outflow, frequent policy regulation and tight refinancing as a whole, and naturally have the characteristics of high credit risk.

In fact, since 2018, with the marginal tightening of real estate financing and the arrival of the peak of real estate corporate bonds maturity, the default of real estate bonds has gradually been exposed. Especially since May last year, local regulatory policies have been tightened again, and the continuous financing shortage has stretched the capital chain of some real estate industries.

After the default of three real estate enterprises in the first half of this year, the institutions intensified their risk investigation on the real estate sector, and their attitudes tended to be cautious. "Some small and medium-sized housing enterprises have relatively high debt ratios, and the financing channels faced by the industry have narrowed, so they are prone to default." Macro analyst Zhou Maohua told reporters.

It is also worth mentioning that on July 12, Sichuan 100 billion-level housing enterprise Blu-ray Development Co., Ltd. also defaulted. The announcement shows that as of the end of the due date, the issuer failed to raise the full repayment funds as agreed, and "19 Blu-ray MTN001" failed to repay the principal and interest in full on schedule, which constituted a material breach of contract.

It is reported that the issuance scale of "19 Blu-ray MTN001" is 900 million yuan, with a term of 2 years. The interest rate of the bonds in this interest period is 7.5%, and the amount of principal and interest payable is 967.5 million yuan. The redemption date is July 11, 2021 (the actual redemption date is July 12, 2021).

Looking forward to the future credit bond market, many people in the industry expressed optimism. The aforementioned fixed income director of the fund company told reporters that it is expected that the credit default situation will continue in the second half of the year. After all, the credit financing environment has not been relaxed, and the policy has been tightening the review of urban investment bonds and real estate bonds. The performance of the credit market will be more differentiated, and the sinking of qualifications will be more cautious.

Zhou Maohua said that from the trend, domestic defaults will not rise sharply, mainly because the overall domestic monetary and credit environment remains reasonable and moderate, and accurately supports short-term weaknesses. At the same time, the economy and domestic demand are recovering steadily, the overall profit of enterprises tends to improve, and the market financing function is sound.

"We should treat the domestic bond market default rationally. A certain amount of bond default will help to find the market price, force enterprises to operate steadily, reasonably debt, and continuously improve operating efficiency; It also helps the market mechanism to play its role and promote the efficiency of market resource allocation. " Zhou Maohua also mentioned.

Decreasing the redemption rate of default bonds

As the default of credit bonds tends to be normalized, there is also a phenomenon that the payment ratio of default bonds is also decreasing.

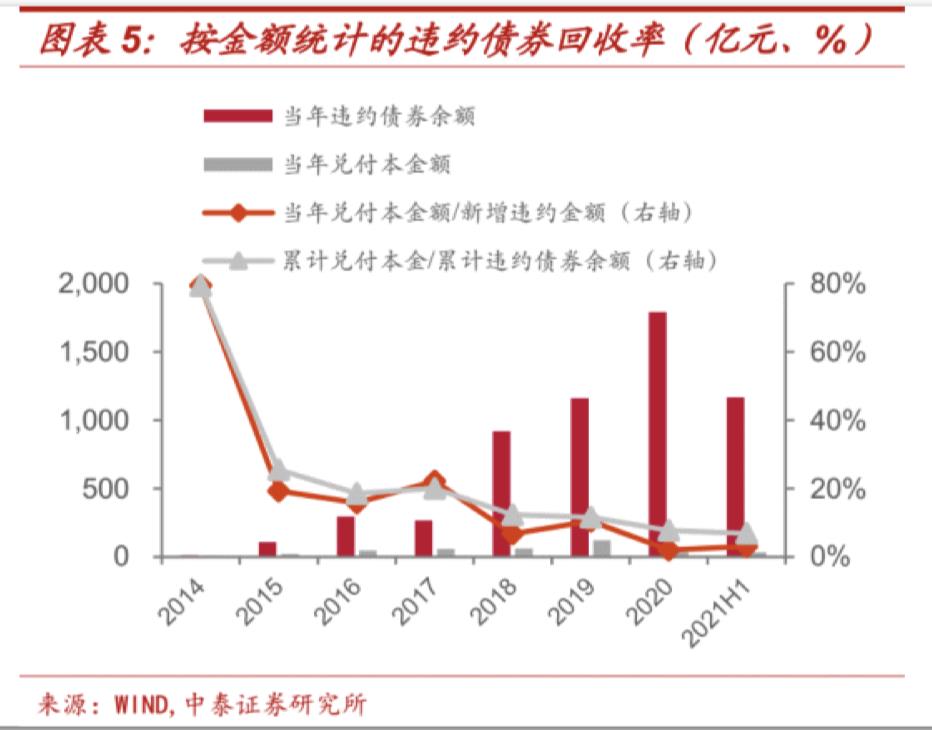

According to the statistics of Zhongtai Securities, the proportion of the accumulated principal paid by default bonds to the accumulated balance of default bonds has dropped from 79.37% at the end of 2014 to 6.87% at the end of the first half of 2021; The proportion of fully paid bonds to default bonds decreased from 20% to 7.16%. This means that once the bond defaults, investors will face greater losses.

Generally speaking, after the bond defaults, enterprises mainly have five ways to deal with the default, namely litigation arbitration, bankruptcy litigation, self-financing repayment, debt restructuring and collateral disposal/guarantor compensation. In general, self-raised funds, debt restructuring and bankruptcy litigation are three common disposal methods, among which debt restructuring and self-raised funds have shorter redemption period and higher recovery rate than bankruptcy restructuring.

In addition, there are differences in default payment of different types of bonds. For example, from the perspective of the nature of enterprises, Zhongtai Securities analyzed that by the end of June 2021, 40 of the 135 private enterprises that had defaulted on bonds had partially or fully paid the defaulted bonds, with a redemption probability of 29.63%; However, local state-owned enterprises and central state-owned enterprises have higher redemption probabilities, which are 38.46% and 36.36% respectively.

However, in recent years, with the substantial increase in the default scale of local state-owned enterprises and the successive default of bonds issued by some central enterprise groups, "the redemption ratio of local state-owned enterprises and central enterprises according to the amount of redemption and the number of fully redeemed bonds has been lower than that of private enterprises." Zhou Yue, chief analyst of Zhongtai Securities Solid Revenue, said.

Specifically, in the first half of 2021, the cumulative redemption amount of local state-owned enterprises accounted for 5.03% of the bond default scale, compared with 13.95% at the end of 2018; The proportion of central enterprises is 4.20%, and it was 17.26% at the end of 2018. Zhou Yue further believes that at present, there are two tendentious problems in the default of credit bonds. First, weak state-owned enterprises will become a breakthrough to break the just-redeemed; Second, the tail real estate company will accelerate the market clearing.

My hometown is Sangzhi County, Zhangjiajie City, and I am a Tujia boy. Different from the general New Year’s Eve dinner, we usually have a reunion dinner in the early morning of the New Year’s Eve, almost as early as possible, and families will start preparing from dawn.

Therefore, every year at the reunion dinner, the family will experience the moment when the sky is bright after eating. If we are lucky, we can also hear the sound of fireworks and firecrackers set off by nearby residents during the reunion dinner. On this day, people will look forward to the good weather in the coming year, just like farmers, and they all hope that all their wishes will come true and everything will go well in the new year.

Family members have been preparing dishes for the reunion dinner since early in the morning.

When I was a child, I heard from the older generation that Tujia people have the custom of catching up with the New Year, usually having a reunion dinner on the night of the 29th of the twelfth lunar month. But as a Tujia, I have had a reunion dinner on the morning of New Year’s Eve since I was a child. Yes, this is our morning New Year’s Eve dinner.

This year is the same. Our family chose to have a reunion dinner at our third aunt’s house. It is said that three aunts and three uncles have been buying food since the beginning of the twelfth lunar month, including killing pigs from the countryside, and then finding people to smoke them into bacon and sausages. Smoked bacon can be steamed, fried and cooked, and each method is delicious.

Except for bacon, the menu of the annual reunion dinner is "confidential", and people who come to eat don’t know what to eat until the food is served on the table. This year, I asked my third aunt for a menu in advance, including: steak, steamed sausage, fried bacon, pig’s head meat, chicken hotpot, tasty fish, bacon trotters and so on.

I got up early, set out from home and walked.13I came to my third aunt’s house in minutes, and it was early morning.sixHalf past ten. Three aunts and three uncles are already busy. "Honey, thaw the pig’s trotters first, then wash them. I’ll wash those small dishes first. After you finish, then cut the sausage." Third aunt shouted.

At this time, it was just dawn outside. In the words of my composition when I was a child, it was "the sky turned into a fish-belly white". The preparation of the two people’s dishes lasted for almost an hour, and I would help them from time to time. After washing the vegetables, it was already bright outside.

It was dawn after eating, and fireworks sounded outside the house.

At this time, I came to the most important link.——Cooking. My uncle used to work in the cookhouse squad of the army, so he naturally cooked the reunion dinner. Ignite, take out the pot, burn oil and hot dishes. One by one, the ingredients change from raw to cooked in the pot, and the hot air and aroma are intertwined. Third Aunt can’t help but say, "The dishes smell good!"

fromeightAt half past ten, relatives at home knocked at the door one after another, and my brother and nephews scrambled to open the door. "Happy New Year!" Every guest who comes in will say such a sentence. In a short time, the house was full of people.

The dishes were brought to the table and the table was quickly filled. People who were sitting around the fire table smelled the fragrance and came to the table automatically. There is a special program of Spring Festival on the news channel on TV. Overseas Chinese all live the same festival belonging to China people in different places.

Our whole family picked up cups and raised their glasses to wish a happy New Year. It was cloudy that day. Although the sun didn’t come out, there were bursts of fireworks and firecrackers outside the house.——People have a reunion dinner on the morning of New Year’s Eve, saying goodbye to the old and welcoming the new, hoping for a better year.

Xiaoxiang morning herald reporter Man Yankun

News clue breaking channel: the application market downloads the "Morning Video" client and enters the topic of "Morning Help"; Or call the morning video news hotline 0731-85571188.

作者:高惺惟(中央党校〔国家行政学院〕习近平新时代中国特色社会主义思想研究中心研究员)

日前召开的中央金融工作会议指出,“金融是国民经济的血脉,是国家核心竞争力的重要组成部分,要加快建设金融强国”。我国金融正处在由“大”到“强”的关键时期,机遇与挑战并存。建设金融强国,必须坚持和加强党的全面领导,坚定不移走中国特色金融发展之路,推动我国金融高质量发展。

1.金融是国民经济的血脉和国家核心竞争力的重要组成部分

习近平总书记指出:“金融活,经济活;金融稳,经济稳。经济兴,金融兴;经济强,金融强。经济是肌体,金融是血脉,两者共生共荣。”党的二十大报告指出,“高质量发展是全面建设社会主义现代化国家的首要任务。发展是党执政兴国的第一要务”。金融是现代经济的核心,能够通过发挥配置资源的功能助推一国生产力发展、经济腾飞、科技创新和产业升级,是国家重要的核心竞争力。加快建设金融强国,是我国经济社会发展的需要,也是我国经济长远发展的战略抉择,更是在金融全球化进程中维护国家金融安全的需要,事关国家繁荣富强、社会和谐稳定、人民幸福安康。全面建成社会主义现代化强国需要建设一个金融强国。

Finance is the blood that nourishes the body of the economy, and it is a symbiotic relationship with the real economy. The development of finance depends on the real economy, and the development of the real economy needs the empowerment of financial services. Specifically, financial institutions can provide necessary financial support for the real economy, thus promoting the development of the real economy. Finance can enlarge the production capacity and market space of start-ups and prolong the energy storage time of new technologies. By building a modern financial institution and market system, diversified financial services can guide more resources into new fields and new tracks, which is conducive to the accumulation of new kinetic energy in the real economy. All work in the financial sector actively serves the implementation of major national strategies, and can continuously inject "flowing water" into the implementation of relevant strategies by optimizing the allocation of financial resources in rural revitalization, scientific and technological innovation, small and micro enterprises, green development and other fields, adding new vitality to the high-quality development of the economy and society. Finance is an important tool to stabilize macroeconomic operation. By strengthening policy implementation and work promotion and maintaining reasonable and abundant liquidity, the cost of social financing can be effectively reduced, thus stabilizing the market expectation of the real economy and providing a good financial environment for economic and social development.

Finance is an important core competitiveness of a country, financial system is an important basic system in economic and social development, and financial security is an important content of national security. Since its birth, the Communist Party of China (CPC) has recognized the importance of finance, attached great importance to financial work, and ensured the financial cause to move in the right direction. From supporting the revolutionary war, to establishing a new regime, and then to serving the socialist modernization, the financial industry has achieved leap-forward development again and again. Since the 18th National Congress of the Communist Party of China, under the centralized and unified leadership of the CPC Central Committee, China’s high-quality financial development has made new major achievements, the financial system has been continuously improved, and financial supervision has been improved, which has effectively supported the overall economic and social development in the new era and made important contributions to building a well-off society in an all-round way as scheduled and achieving the goal of the first century. In the new era and new journey, Chinese modernization will comprehensively promote the construction of a strong country and the great cause of national rejuvenation. We must speed up the construction of a financial power, comprehensively strengthen financial supervision, improve the financial system, optimize financial services, guard against and resolve risks, unswervingly follow the road of financial development with China characteristics, and promote the high-quality development of China’s finance.

2. The inherent requirements of a socialist modern financial power

The first is people’s nature. "People’s interests first" is the value pursuit of China’s financial work. If finance does not serve the interests of the country and the people, there will be chaos in the financial field. Financial work must adhere to the people-centered value orientation, the fundamental purpose of financial services to the real economy, the eternal theme of financial work, the deepening of structural reform on the financial supply side, the overall planning of financial opening and security, and the general tone of striving for progress while maintaining stability. This requires the financial work to practice the Party’s purpose, the financial system to improve its political position, adhere to political principles, firm its political direction and maintain its political strength, and always bear in mind that the Party’s purpose is to serve the people wholeheartedly, and the people’s position is the fundamental position of the Party and the fundamental position of the financial work led by the Party.

The second is marketization. The central financial work conference pointed out that "we should persist in promoting financial innovation and development on the track of marketization and rule of law". Market economy is essentially an economy in which the market determines the allocation of resources. Practice has proved that the allocation of resources by the market is the most efficient way of resource allocation. To improve the level of market-oriented allocation of financial resources, on the one hand, we must vigorously develop the capital market, optimize the financing structure, and give full play to the hub function of the capital market. The development degree of capital market represents the development degree of financial marketization in a certain sense, and it is the most dynamic platform in the financial system. Developing capital market plays a key role in building a modern economic system. On the other hand, we should steadily promote the reform of interest rate marketization, so that interest rates can give full play to the role of guiding resource allocation. Steadily promoting interest rate marketization is one of the core contents of improving macro-control and deepening financial reform in China, and the interest rate marketization reform can play a vital role in the efficient allocation of funds.

The third is internationalization. Adhere to both "bringing in" and "going out", steadily expand the institutional opening of the financial sector, enhance the facilitation of cross-border investment and financing, attract more foreign-funded financial institutions and long-term capital to develop their businesses in China, and serve the construction of the "Belt and Road". To this end, it is necessary to further optimize the business environment, continue to significantly reduce the restrictions on foreign investment access, create a new platform for international cooperation, provide global investors with a stable investment place under the rule of law, and strive to become the first choice for foreign enterprises to invest. Adhere to the overall planning of financial opening and security, and strive to promote high-level financial opening. High-level financial openness requires steady and prudent internationalization of RMB, which will help enterprises to guard against the risk of liquidity shortage, realize the stability of global foreign exchange reserves, and make RMB an "anchor currency", which is the need of rebalancing global economic development.

The fourth is technology. The financial industry is an information-intensive industry, and information is very important to the financial industry. According to the theory of financial intermediary, financial intermediary has the function of information production, which can provide information to the market and alleviate the information asymmetry between the two parties. Due to the advantages of network in information production and transmission, financial technology not only speeds up information transmission, but also improves the ability of information collection and reduces the cost of information processing, thus improving the information production ability of financial intermediaries. At present, the network has become a platform for human beings to create and share information, and the traditional information dissemination mode is undergoing essential changes under the promotion of network information technology. Financial technology promotes the integration of electronic information technology and traditional finance, innovates the financial format, increases the convenience of financial services, and improves the quality of financial services to the real economy in many fields.

The fifth is inclusiveness. The purpose of inclusive finance is to enable everyone to get financial services at the right price in a timely and dignified manner when they need them. Inclusive finance is consistent with the development concept of "sharing". The economic value of inclusive finance lies in helping to adjust the imbalance between supply and demand of finance, especially the imbalance between supply and demand of financial structure, so that finance can better serve the real economy. The social value of inclusive finance lies in helping low-income people and small and micro enterprises to obtain financial services, so that everyone can have the right to enjoy financial services fairly. In essence, inclusive finance helps low-income groups and small and micro enterprises get the right to get rich through fair development, which can promote inclusive economic growth and harmonious social development.

The sixth is security. The Central Financial Work Conference called for "strengthening financial supervision in an all-round way and effectively preventing and resolving financial risks". Preventing financial risks and maintaining financial security are the eternal themes of financial work. Financial markets and financial institutions must be supervised according to law in order to better guard against financial risks and safeguard the interests of investors. Financial institutions are different from ordinary enterprises, and once something goes wrong, it may lead to systemic risks. The financial industry has strong publicity, externality and sociality, and financial risks are highly contagious and hidden, which requires that financial supervision must be strict, "measuring to the end with a ruler".

3. Promote the construction of a strong financial country with structural reform on the financial supply side.

Over the past 40 years, China’s financial system has been continuously improved in the reform. To build a strong financial country, we must continue to rely on reform, especially deepen the structural reform of the financial supply side, improve the financial market, financial institutions and financial product systems by optimizing the financial structure, clarify the market-oriented objectives and strengthen the responsibility of supervision, and keep the bottom line that systematic financial risks do not occur.

Give full play to the function of the capital market hub. For a long time, China mainly relied on the indirect financing system dominated by banks, which led to a high leverage ratio of enterprises and increased financial risks to some extent. Therefore, it is necessary to further improve the financial market structure, enlarge and strengthen the capital market, build a standardized, transparent, open, dynamic and resilient capital market, and increase the proportion of direct financing. At the critical stage of China’s economy from high-speed growth to high-quality development, the capital market will play a central role in adjusting the industrial structure and building an innovative economic system. Since the reform and opening up, China’s capital market construction has made great progress, but it still faces the problems of low efficiency and imperfect mechanism. To further improve the capital market in the new period, on the one hand, let the capital market play a decisive role in resource allocation. We will promote the deepening of the stock issuance registration system, develop diversified equity financing, vigorously improve the quality of listed companies, and cultivate first-class investment banks and institutions. On the other hand, better play the role of the government. The regulatory authorities maintain the fairness and transparency of the market, resolutely crack down on illegal activities such as market manipulation, insider trading and false information disclosure, and pay more attention to protecting the interests of investors.

Steadily and prudently promote the internationalization of RMB. As long as China’s economy can maintain a high-quality growth momentum, RMB internationalization will be realized stably. In this process, it is necessary to cultivate high-quality development and high-level open microeconomic entities, with the focus on improving the competitiveness of enterprises and products. In addition, we will unswervingly deepen reform and opening up in the financial sector. In the future, the interest rate and exchange rate of RMB should be determined by the market, and the opening of capital account and financial market should be promoted step by step under the principle of efficiency, stability and effectiveness, so that offshore RMB can have a better investment place. Improve the infrastructure construction of RMB internationalization, and strive to realize the services of RMB cross-border payment system (CIPS) wherever there is RMB.

Build a modern central banking system and always maintain the stability of monetary policy. The independence of the central bank is an important part of the modern central banking system. We should strive to create a good monetary and financial environment, always maintain the stability of monetary policy, pay more attention to cross-cycle and countercyclical adjustment, and enrich the monetary policy toolbox. At present, the main goal of unblocking the transmission mechanism of monetary policy is to establish the transmission mechanism of price-based monetary policy by deepening the interest rate marketization reform, taking the loan market quotation rate (LPR) indirectly regulated by the central bank as the operational goal of monetary policy, taking the deposit and loan interest rate of financial institutions determined by market supply and demand as the intermediate goal of monetary policy, and keeping the currency stable and promoting economic growth as the ultimate goal of monetary policy.

Adhere to the implementation of inclusive finance. An important part of promoting the structural reform of the financial supply side is to build a multi-level, wide-coverage and differentiated banking system. In this system, commercial banks, policy banks, city commercial banks, rural financial institutions, private banks and village banks have their own positions, perform their duties and complement each other. State-owned commercial banks should define their position, take the establishment of modern enterprise system as the guide, and keep a close eye on the core goal of "becoming stronger, better and bigger". Policy banks should clearly define their functions, clarify their business boundaries, and take national interests and national strategic needs as their business values. Their main role is to make up for market failures in some areas and do things that commercial banks are unwilling to do, cannot do and cannot do well. Rural commercial banks can better serve small and medium-sized enterprises by relying on the long-term accumulated local credit and its flexible interest rate policy. They should identify their own differentiated positioning, establish business priorities, pay attention to meeting the differentiated, personalized and customized business needs of "agriculture, rural areas and farmers" and small and medium-sized enterprises, and "do small things" to reduce the loan concentration and the loan scale per household.

Comprehensively strengthen financial supervision and effectively prevent and resolve financial risks. Comprehensively strengthen institutional supervision, behavioral supervision, functional supervision, penetrating supervision and continuous supervision, eliminate regulatory gaps and blind spots, and better safeguard financial security. First, improve the modern financial enterprise system with China characteristics, improve the management of state-owned financial capital, broaden the channels for bank capital replenishment, and do a good job in risk isolation between industry and finance. Early identification, early warning, early exposure and early disposal of risks, sound early correction mechanism of financial risks with hard constraints, and timely disposal of risks of small and medium-sized financial institutions. The second is to establish a long-term mechanism to prevent and resolve local debt risks, establish a government debt management mechanism that is compatible with high-quality development, and optimize the debt structure of central and local governments. The third is to prevent financial risks caused by the real estate market. Promote a virtuous circle between finance and real estate, improve the main supervision system and fund supervision of real estate enterprises, improve macro-prudential management of real estate finance, and meet the reasonable financing needs of real estate enterprises with different ownership equally. The fourth is to strengthen the supervision of financial technology. The rapid development of financial technology has enhanced the concealment of financial risks, added many new financial risk points, and put forward higher requirements for the ability of financial supervision. Therefore, financial supervision departments need to innovate financial supervision means and balance the relationship between financial innovation and financial security, so as to encourage financial innovation that will help improve the efficiency of financial services and control financial risks within a safe range.

Guangming Daily (November 10, 2023, 06 edition)

CCTV News: Huang Xintong is a flower skater in China. He once won the national championship in 2006-07 season, the fifth place among university students in the world, the second place in the Asian Winter Games, the eighth place in the four continents flower skating championships, the 21st place in the 2007 World Championships and the final champion of the 11th Winter Games. The picture shows Huang Xinyi’s exquisite and beautiful photo.

|

Exquisite photo of ice dancing beauty, youthful beauty is full of beautiful style.

|

Exquisite photo of ice dancing beauty, youthful beauty is full of beautiful style.

British media reported on the 25th that 20 Minutos, Spain’s largest newspaper, voted online on its website and selected "the most beautiful female politician in the world". Luciana Leon, a young female parliamentarian from Peru, was ranked first for the time being. Other beautiful politicians on the list include US Secretary of State Hillary Clinton and Republican vice presidential candidate Palin, and China Foreign Ministry spokeswoman Jiang Yu is also on the list, ranking 37th.

Peruvian beauty is known as "the eighth wonder"

According to the report, 54 female politicians shortlisted for this vote came from 30 countries including Israel, Italy, Afghanistan, Ukraine and Finland.

At present, the voting results show that Luciana Leon, a Peruvian congresswoman who is a lawyer, won about 24,000 votes and was temporarily elected as the "most beautiful female politician" in the world. The blond Leon is 30 years old and is now the youngest member of Congress in Peru. One voter described her as having an "angel face", and even worse, praised her beauty as "the eighth wonder of the world".

In the second place, a female member of parliament from Peru, 47-year-old Mercedes Arauz, won about 15,000 votes. She is Peru’s Minister of Foreign Trade and Tourism.

Two Chinese are on the list.

On the Chinese side, there are two Penny Wong the list, namely, China Foreign Ministry spokeswoman Jiang Yu, ranked 37th, and Australian Minister of Climate Change and Water Resources Huang Yingxian, ranked 48th. Voters gave Jiang Yu an evaluation that she was beautiful and generous, and her manners were quite decent.

Jiang Yu, 44, was born and raised in Beijing. She graduated from the Foreign Affairs College, the cradle of China diplomats, in 1986. She was proficient in English and worked in the Permanent Mission of the Ministry of Foreign Affairs of China to the United Nations. Since 2003, she has been a spokesperson for the Office of the Commissioner in. At the end of 2005, she was transferred back to the Information Department of the Ministry of Foreign Affairs in Beijing as a political counselor. In 2006, she became the deputy director and spokesperson of the Information Department of the Ministry of Foreign Affairs.

Hillary Clinton was shortlisted for the "oldest"

Palin, a 44-year-old US vice presidential candidate, ranked 24th with 3,173 votes. The 61-year-old US Secretary of State Hillary Clinton ranked 34th. She is the oldest female politician on the list. In addition, Tymoshenko, the Ukrainian Prime Minister whose beauty has long been recognized by the outside world and known as the "natural gas princess", ranked eighth. Royal, a French socialist who lost to Sarkozy in the presidential election, ranked 36th.

The female parliamentarians on the German list are only 22 years old.

The youngest female politician on the list is Julia Bunker, a 22-year-old female member of parliament from Germany. She was elected as a member of parliament at the age of 18 and is the youngest state member in Germany’s history. She holds high the banner of anti-Nazi, and is a high-profile political star in Germany recently. She ranks 22nd on the list.

Fujikawa Yuri, known as the most beautiful Japanese parliamentarian, also made the list, ranking fifth. Fujikawa Yuri has a star-like face. Earlier, in order to promote the tourism industry in her hometown, she tried her best and even boldly launched a photo album to boost the local economy.

None of the British female politicians was selected.

Surprisingly, there are many young and beautiful female parliamentarians in Britain, and no one is selected for this list. This inevitably makes British journalists somewhat frustrated. In this regard, the British "Daily Mail" said: "British female politicians may not attract the attention of people in other countries in the world in terms of appearance, but they are also very eye-catching."

A reporter from 20 Minutes said: "I don’t think British female politicians are famous for their beauty, but if you browse female politicians around the world, some of them are really attractive."

According to him, hundreds of readers sent emails to the voting website to discuss their views, but none of them volunteered to add British female politicians to the voting list of the "Global Beauty Politicians List".

Spain has five female politicians on the list, which is the country with the largest number of finalists, followed by the United States and Mexico with four people on the list.

China Daily Yang Zong

Editor: Li Erqing